colorado springs sales tax calculator

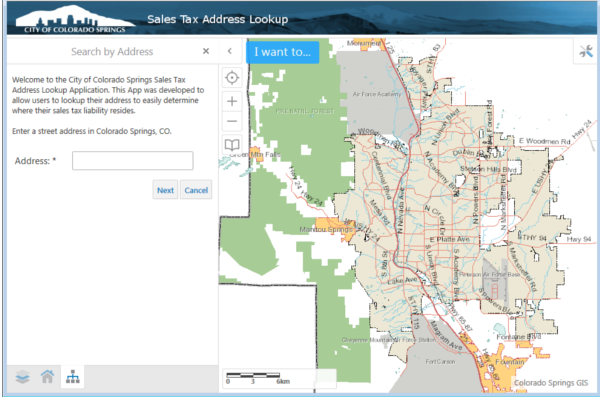

Manufactured homes in Colorado but not other forms of prefabricated housing must be titled with the Colorado Department of Revenue. Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Colorado Springs sales tax in 2021.

Sales Tax Information Colorado Springs

If your business purchased or consumed items with an invoice date of 12312020 and prior the use tax will be due at the previous tax rate of 312.

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Average Local State Sales Tax. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Colorado Springs does not currently collect a.

The statewide sales tax in Colorado is just 290 lowest among states with a sales tax. Colorado Springs CO Sales Tax Rate The current total local sales tax rate in Colorado Springs CO is 8200. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45.

Maximum Possible Sales Tax. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. All applicable sales andor use taxes must be paid before the Department or.

However as anyone who has spent time in Denver Boulder or Colorado Springs can tell you actual sales tax rates are much higher in most cities. Did South Dakota v. How to Calculate Colorado Sales Tax on a Car To calculate the sales tax on your vehicle find the total sales tax fee for the city.

Sales Tax Breakdown Colorado Springs Details Colorado Springs CO is in El Paso County. Ad Automate Standardize Taxability on Sales and Purchase Transactions. City sales tax collected within this date range will report at 312.

The average cumulative sales tax rate in Manitou Springs Colorado is 903. Manitou Springs is located within El Paso County Colorado. For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 29.

The combined amount is 820 broken out as follows. 307 City of Colorado Springs self-collected 200 General Fund 010 Trails Open Space and Parks TOPS. Instructions for City of Colorado Springs Sales andor Use Tax Return 312 Sales and Use Tax Return.

Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. Multiply the vehicle price after trade-ins but before incentives by the sales tax fee. This downloadable spreadsheet combines the information in the DR 1002 sales and use tax rates document and information in the DR 0800 local jurisdiction codes for sales tax filing in one lookup tool.

Sales tax in Colorado Springs Colorado is currently 825. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The Colorado Springs sales tax rate is.

The spreadsheet includes local option exemptions for state-collected. The Colorado sales tax rate is currently. The December 2020 total local sales tax rate was 8250.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The County sales tax rate is. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county sales tax a 312 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

This information is intended to provide basic guidelines regarding the collection of sales and use tax ownership tax and license fees. Motor vehicle dealerships should review the. For tax rates in other cities see Colorado sales taxes by city and county.

Ownership Tax Calculator Estimate ownership taxes. S Colorado State Sales Tax Rate 29 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the Colorado Springs Sales Tax Calculator or compare Sales Tax between different locations within Colorado using the Colorado State Sales Tax Comparison Calculator. Historical Sales Tax Rates for Colorado Springs 2022 2021 2020.

Integrate Vertex seamlessly to the systems you already use. Just enter the five-digit zip code of the location in which the transaction takes. Maximum Local Sales Tax.

This is because many cities and counties have their own sales taxes in addition to the. How to use Colorado Springs Sales Tax Calculator. Fountain Live in Buy in.

The sales tax rate for Colorado Springs was updated for the 2020 tax year this is the current sales tax rate we are using in the Colorado Springs Colorado Sales Tax Comparison Calculator for 202223. You can print a 82 sales tax table here. The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods.

Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list. The minimum is 29. Location Tax Rates and Filing Codes.

Colorado Springs is in the following zip codes. Sales Tax State Local Sales Tax on Food. Download all Colorado sales tax rates by zip code The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax.

Avalara provides supported pre-built integration. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. Colorado Sales Tax Calculator You can use our Colorado Sales Tax Calculator to look up sales tax rates in Colorado by address zip code.

This includes the rates on the state county city and special levels. Within Manitou Springs there is 1 zip code with the most populous zip code being 80829. For those who file sales taxes.

The sales tax rate does not vary based on zip code. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. What is the sales tax rate in Colorado Springs Colorado.

Real property tax on median home. 80901 80902 80903. This is the total of state county and city sales tax rates.

Vous Etes Francais Travaillant En Suisse Savez Vous Que Votre Salaire Brut Pourrait Etre Taxe De 7 50 Tax Preparation Tax Services Tax Return

Here Are Some Helpful Tips To File Your Taxes Like A Pro Tax Help Budgeting Money Tax Deductions

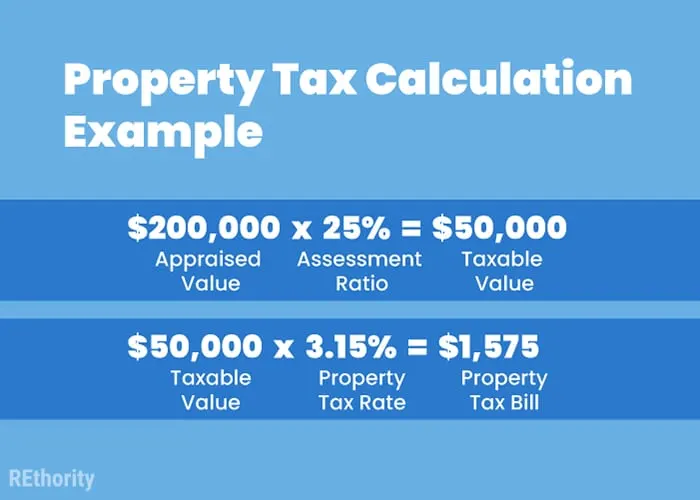

Property Tax Calculator Property Tax Guide Rethority

The Consumer S Guide To Sales Tax Taxjar Developers

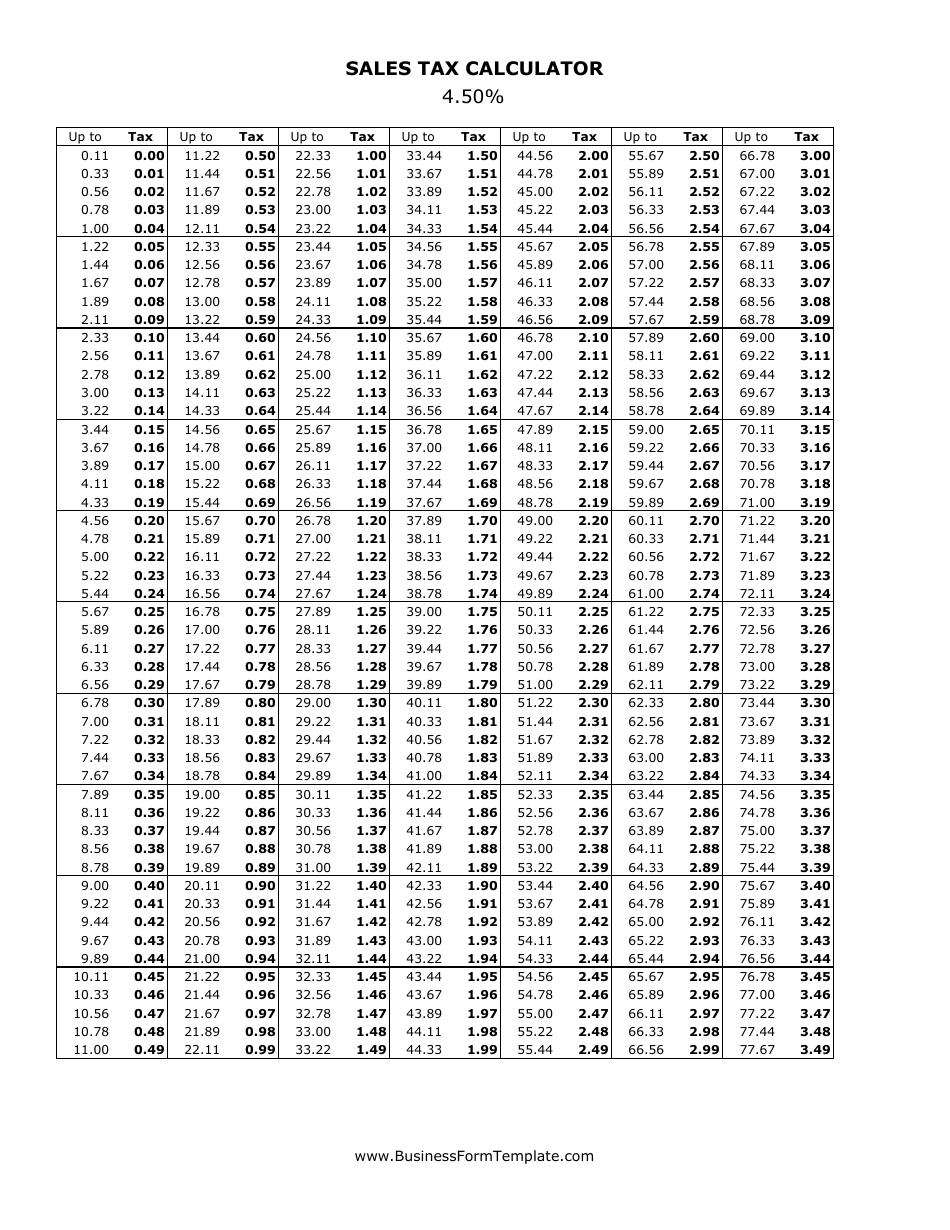

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

8 25 Sales Tax Calculator Template

Sales Tax Information Colorado Springs

How To Calculate Cannabis Taxes At Your Dispensary

Sales Tax Information Colorado Springs

Property Tax Calculator Property Tax Guide Rethority

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Property Tax Calculator Property Tax Guide Rethority

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

All About Taxes Real Estate Investing Being A Landlord Property Management

Airbnb Rules In Colorado Airbnb Laws Taxes And Regulations The Leading All In One Vacation Rental Management Software For Pros Hostaway